The Ultimate Goal Of Estate Planning

Proper estate planning serves the ultimate goal of ensuring that your assets and responsibilities are managed and distributed according to your wishes, both in the short term and long term.

In the short term, the immediate protection of your assets is the primary goal. This involves designating guardians for minors, establishing powers of attorney for sudden incapacity, and creating an emergency fund for unforeseen events, ensuring immediate financial security. Additionally, updating or creating a will to reflect current relationships and assets is essential for short-term goals.

Looking ahead to the long term, estate planning aims at securing your financial legacy for your heirs while minimizing taxes and legal complications. It involves providing clear instructions for health and end-of-life care, as well as setting up trusts or other mechanisms to provide for children’s education and future needs. Planning for retirement and elder care, including long-term healthcare and living arrangements, also falls under long-term goals.

Effective estate planning is not a static process but one that adapts to life changes, such as marriage, the birth of children, or significant financial alterations. Safeguarding your interests and those of your loved ones to ensure their peace of mind and reduce potential conflicts or legal issues in the future is the name of the game. Addressing these short-term and long-term objectives in an estate plan means you can materialize your values and priorities while providing security for you and your beneficiaries.

When To Start Planning

The best time to start estate planning is now. It is never too early to begin, and life’s unpredictability means that having a plan in place is wise, regardless of how young you may be. Starting early also allows for more comprehensive planning, considering different life stages and potential changes. While it is never too late to start, the sooner you do, the better you can prepare for various contingencies, ensure your wishes are respected, and provide for your loved ones.

The Basics – Every Phase In Life Is Different

Far from being one-size-fits-all, estate planning is nuanced. It demands being tailored to suit individual circumstances and stages of life that necessitate refinements to existing estate plans, reflecting evolving priorities and responsibilities.

In the early years of adulthood, designating a healthcare proxy or granting power of attorney, laying the groundwork for future decision-making in times of need, will likely be your focus. For those with young families, a pressing concern is appointing guardians for minor children, ensuring their care and well-being in unforeseen circumstances.

As people move on through mid-life, their focus often shifts towards asset management, planning for educational expenses, and providing care for their aging parents. This phase brings forth a balancing act of financial obligations and familial responsibilities.

Approaching retirement, a comprehensive review of your estate plan will become increasingly important. Considerations extend beyond mere asset distribution to encompass legacy planning, addressing long-term care needs, and ensuring a comfortable retirement for oneself and loved ones.

Each life stage introduces its set of unique considerations, underscoring the necessity of periodic review and adjustment. By staying attuned to evolving circumstances and priorities, you can ensure your estate plan remains aligned with your intentions and goals, effectively serving you and your beneficiaries’ needs.

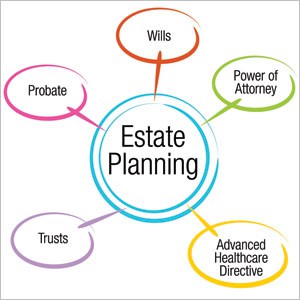

Key Documents

A robust estate planning portfolio will contain several documents. Each plays its own role in securing your and your family’s well-being across several possible outcomes. Although not necessarily an exhaustive list, these documents generally include:

Wills specify how assets should be distributed after death.

Durable Power of Attorneys designate someone to handle financial affairs if you become incapacitated.

Living Wills (Advance Directive) state your wishes for end-of-life medical care.

Beneficiary Designations ensure certain assets like life insurance or retirement accounts are passed to designated individuals.

Trusts are legal arrangements where one party holds property for the benefit of another. They can be used for asset protection, tax planning, or to control how and when assets are distributed.

Letters Of Intent provide guidance on your wishes, which may not be legally binding but can help inform executors and beneficiaries.

Medical Documents To Have In Place

In Texas, key medical documents that everyone, not just older adults, should consider having in place include:

Medical Powers Of Attorney designates someone to make healthcare decisions on your behalf if you become incapacitated.

Directives To Physicians (Living Wills) specify your wishes regarding life-sustaining treatment if you are terminally ill or permanently unconscious.

HIPAA Authorizations allow designated individuals to access your medical records, aiding in informed decision-making about your healthcare.

Out-Of-Hospital Do Not Resuscitate Orders (OOH-DNR) instruct healthcare professionals not to perform CPR in certain situations outside of a hospital setting.

These documents are important for adults of all ages, as they ensure your medical wishes are clearly communicated and respected in case of incapacity or end-of-life situations.

Planning Documents For Parents

As a parent, you are in a unique position where you need to consider things beyond yourself and maybe a spouse — you have children. Other than having a will, trust, and medical power of attorney, I highly advise including a designation of guardian in your estate planning portfolio.

Wills include provisions for the appointment of a guardian for minor children in case both parents pass away. Trusts allow parents to set aside funds for their children’s care and specify how and when these funds should be used. Medical powers of attorney for a child designate someone to make medical decisions for the children if parents are unable to do so.

Finally, the designation of guardians enables nominating a guardian for minor children as a proactive step to ensure that children are cared for by a trusted individual of the parent’s choosing, in the event of a parent’s incapacity or death. This medley of documents generally provides complete coverage for all possible situations where you would need legal designation in place for your child.

Reviewing And Updating Estate Planning Documentation

It is generally recommended to review and update your estate planning documents every three to five years. If a significant life event occurs, you should update your documentation in light of that change immediately, regardless of whether it is been three years.

These types of events include things such as marriage, divorce, birth of a child, death of a beneficiary or executor, significant changes in financial status, and changes in the law. Regular reviews ensure that your estate plan accurately reflects your current wishes, circumstances, and any legal changes.

Probate In Texas

Probate in Texas refers to the legal process of validating a deceased person’s will and administering their estate. This must be done within four years of the person’s death. It involves a court that oversees the distribution of assets to beneficiaries, paying off any debts and taxes, and ensuring that the deceased’s wishes, as expressed in their will, are carried out. If there is no will, Texas laws of intestacy determine how assets are distributed.

Probate can vary from a simple, streamlined procedure for smaller estates to a more complex process for larger ones. The aim is to ensure a fair and legal transfer of assets, resolve any outstanding financial matters, and honor the deceased’s legacy.

Proper Estate Planning And Probate

Proper estate planning can often keep your loved ones out of the probate process in Texas, especially if measures like establishing a living trust are taken. Trusts allow for the direct transfer of assets to beneficiaries without going through probate. Other tools, such as beneficiary designations on accounts and life insurance policies, can also bypass probate. However, the effectiveness of avoiding probate depends on how comprehensively and thoroughly your estate plan is executed. Consulting with an attorney focusing on estate planning will go far to ensure your plan effectively meets your goals and legal requirements.

For more information on The Basics – Every Phase In Life Is Different, an initial consultation is your next best step. Get the information and legal answers you are seeking by calling (956) 513-1117 today.

Secure Your Family's Future Today!

Call Now! - (956) 513-1117